Revolut Revolutionizes Procurement with Acquis and Coupa

Acquis helped Revolut to revolutionize its procurement processes and build a strong, scalable foundation for future growth through Coupa.

Read More

Acquis is a different kind of consulting firm — one that bridges strategy and execution with precision and empathy to deliver outsized results. Through our Think+Do approach, we help organizations shape practical strategies, lead complex initiatives, and manage change in ways that help people and organizations thrive.

Acquis works with life sciences companies — from emerging biotechs to major pharmaceutical firms — to improve innovation speed and operational efficiency. We combine industry expertise with practical execution to help deliver treatments to patients sooner.

Acquis works with life sciences companies — from emerging biotechs to major pharmaceutical firms — to improve innovation speed and operational efficiency. We combine industry expertise with practical execution to help deliver treatments to patients sooner.

Acquis helps private equity general partners drive performance across their portfolio, accelerate technology adoption in their portfolio companies, and better align strategy and execution to deliver outstanding performance.

Acquis works with industry-leading and industry-disrupting technology companies to align their strategy and execution. We have deep experience bringing and implementing complementary technologies, accelerating growth, and building scalable operating models that help technology companies gain market share.

Acquis helps private equity general partners drive performance across their portfolio, accelerate technology adoption in their portfolio companies, and better align strategy and execution to deliver outstanding performance.

Acquis works with leading manufacturers and construction organizations to accelerate strategic evolution and transformation, build and scale technology-driven solutions, engage teams, and accelerate impact.

Acquis makes an impact across the corporate travel ecosystem Whether you are a corporate travel manager looking to optimize your T&E program or a travel supplier aiming to revolutionize your product and services, Acquis offers the expertise and innovative solutions to propel your success.

Acquis thrives in the face of change. We distill complexity into actionable insights. Our expertise connects strategy to execution, turning plans into meaningful, measurable impact. All while putting people at the center.

Acquis helped Revolut to revolutionize its procurement processes and build a strong, scalable foundation for future growth through Coupa.

Read More

Acquis was supportive through all the challenges in how to meet the needs of the business. They jumped on calls when needed and got the right people engaged to help us make decisions or provide further explanations if needed. And they did a great job of keeping us on our target timeline and on budget.

VP of Finance, EyeCare Partners

Working with the team at Acquis has enabled us to deploy a good solution for our needs, and importantly within our budget and timelines

Shared Services Director, Reckitt

Acquis delivers results. We engaged Acquis to drive cost savings through strategic sourcing and process improvement initiatives. They helped us meet or exceed our targets by combining strong expertise with a collaborative, flexible approach.

Pharmaceutical Company

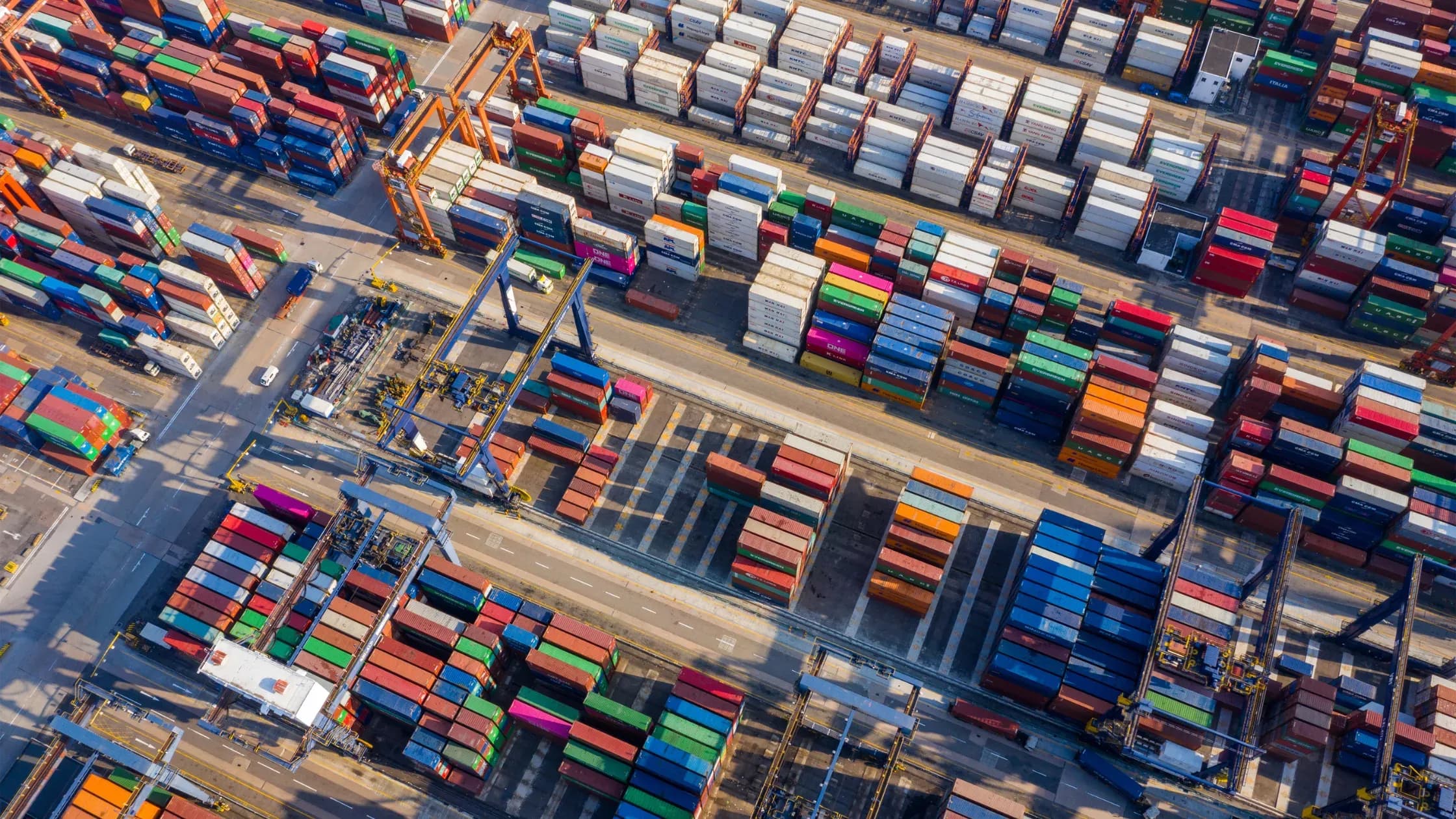

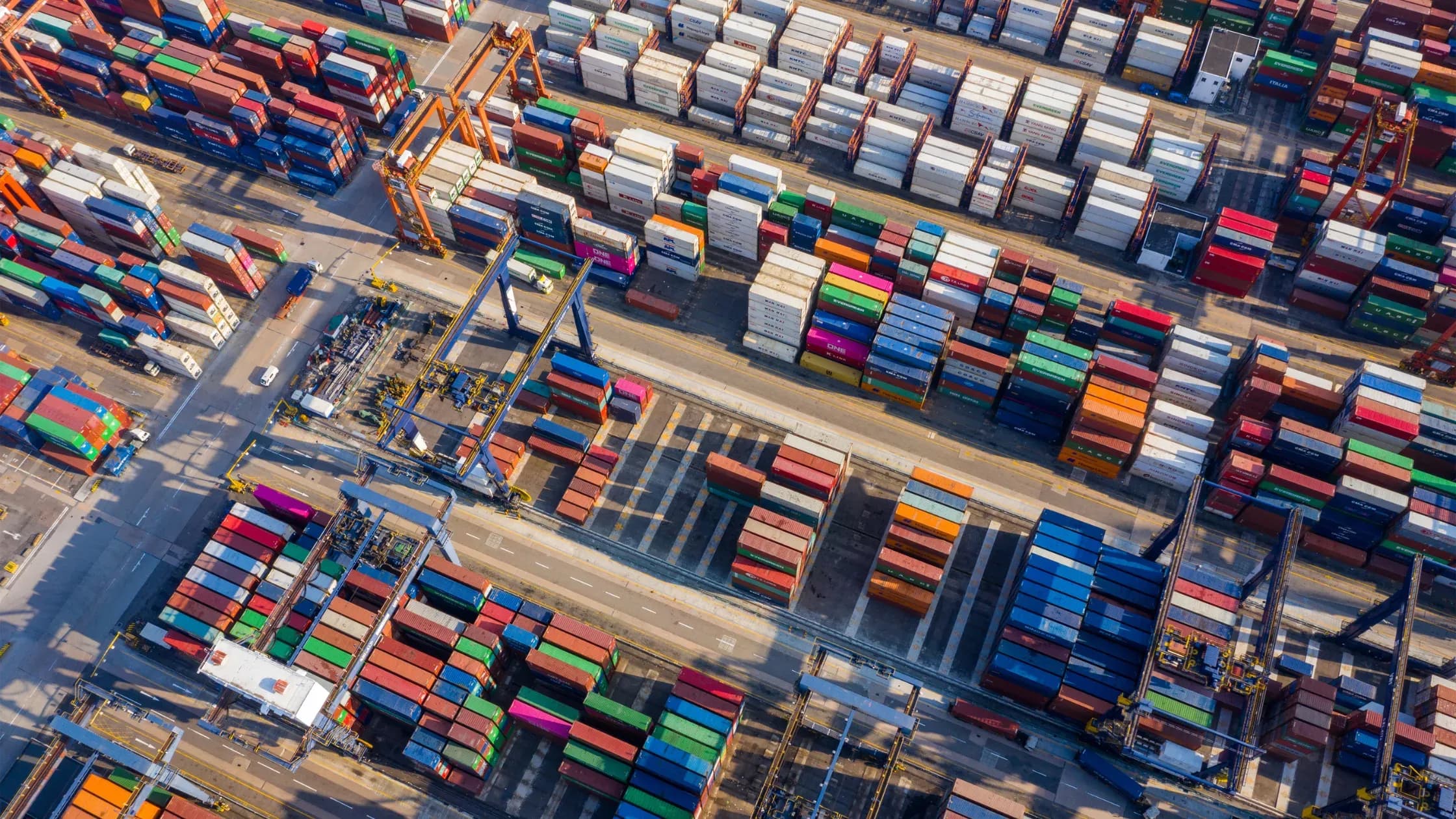

The growing prevalence and fluidity of protectionism and tariffs across the globe mean that a proactive procurement strategy is no longer optional — it is essential for business survival and competitive advantage.

Read More

Application management (AM) is more than a maintenance function. When approached strategically, AM can be a catalyst for business growth.

Read More

Salesforce Agentforce reimagines how enterprises harness Agentic AI to drive business value through intelligent automation.

Read More

The growing prevalence and fluidity of protectionism and tariffs across the globe mean that a proactive procurement strategy is no longer optional — it is essential for business survival and competitive advantage.

Read More

Application management (AM) is more than a maintenance function. When approached strategically, AM can be a catalyst for business growth.

Read More

Salesforce Agentforce reimagines how enterprises harness Agentic AI to drive business value through intelligent automation.

Read More

Acquis Foundation® empowers people who are underserved, marginalized, or faced with hardship. We leverage the strengths of our business and our people to solve meaningful problems, strengthen our communities, and advance together.