Insight

From Vision to Venture: Early-stage Company Investment Vehicles and Instruments

Once an investor opts to make an investment in a business, there are myriad legal considerations. What investment vehicle will the investor use? What instrument will the company use to trade equity for capital?

Part three of From Vision to Venture explores several common instruments used as part of the investment process as well as their respective pros and cons. This list is far from collectively exhaustive. Regardless of the investment vehicle or instrument utilized, both parties should consult with professionals and subject matter experts before agreeing to any legal frameworks.

Suggested reading

Part 1: Securing Early-Stage Capital Commitments

Part 2: Demonstrating Product-Market Fit to Secure Capital

Early-Stage Investment Instruments

Logistically, investors will want to know the investment instrument for your raise. Early-stage raises usually use a SAFE (Simple Agreement for Future Equity) or a convertible note. Since 2013, when Y Combinator introduced SAFEs, they have been the preferred investment instrument for early-stage companies. They are short in length, simple to use, and require very little negotiation or redlining before an investment can be closed. A SAFE is a contract between a startup and investors that gives the investor the right to preferred shares in the startup when the business raises a future funding round. The SAFE outlines how and when the capital converts to equity. SAFEs convert to preferred stock in an equity financing round where the company sells preferred stock at a fixed valuation.

With a SAFE, the variables you can choose to include are a post-money valuation cap and a discount. Typical SAFEs have either one of these variables, both, or neither, depending on startup and investor preference. A usual starting point is a SAFE with a 20% discount (i.e., an 80% discount rate). The post-money valuation cap is the highest valuation at which the invested amount converts to shares in the business.

For example, if the SAFE cap is $5M, but a subsequent round of investors is coming in at a valuation of $10M, that means the SAFE investors will have paid half the amount for their shares compared to what the new investors are paying. SAFEs typically do not require repayment of the investment if it never converts to equity. They do not typically accrue interest and do not usually have a maturity date. Once the company and the investor sign the SAFE, the investment deal is secured, and the money can be transferred.

Convertible notes

Convertible notes are an alternative document to use to secure funding. A convertible note is a document outlining a loan from an investor that can be converted into equity later. Convertible notes are seen as less founder-friendly because they can accrue interest and can have maturity dates (typically 18-24 months) at which time the loan must be repaid or converted to equity. Convertible notes have been around longer than SAFEs and require slightly more involvement in drafting and management in execution. Regardless of which investment vehicle you use, you should have legal and financial experts evaluate the documents and associated stipulations before securing any investment.

More generally speaking, it is critical to engage professional and legal experts. These experts can assist with risk analysis, advise on any potential liabilities, and help choose the optimal strategic path for your business.

Investment Addenda

Addenda can accompany a SAFE or convertible note outlining other stipulations such as pro-rata rights. Pro-rata rights allow the investor to invest more in subsequent funding rounds to maintain their initial percentage of ownership (i.e., protection from dilution). This stipulation can be negotiated between the founder and the investor.

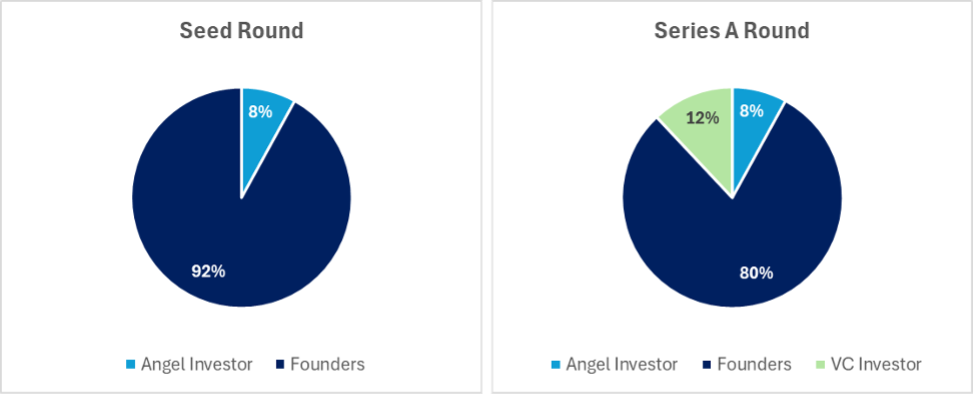

As funding rounds progress, prior investors or founders may become diluted, with their percentage of equity decreasing over time with subsequent investments.

| Round | Founders | Investors |

|---|---|---|

| Seed | 75% | 25% |

| Series A | 55% | 45% |

| Series B | 45% | 55% |

| Series C | 35% | 65% |

| Series D | 25% | 75% |

| Series E | 22% | 78% | Series F | 20% | 80% |

Illustrative Example of Equity Stake Per Funding Round

Early-stage investors are typically friends and family, angel investors, angel syndicates, family offices, and small VCs. The deal size for this stage can vary greatly. As the founder, you can place a limit on the minimum investment required to participate. Placing a bottom limit on investments helps keep your capitalization table (“cap table”) as simple as possible. The cap table summarizes the ownership of an early company and can rapidly become complex.

Some investors may request a seat on the board of directors as a stipulation of the investment. Consider control of the board and who else sits on the board before giving away seats. Generally, an early-stage business may have two to six board members. Some investors accept a board observer seat where the investor can sit in on board meetings but has no voting rights. Effective board members provide connections and expertise and can help the CEO make the best decisions possible when challenges and setbacks inevitably arise.

Conclusion and Acquis Expertise

A compelling pitch deck conveys a considerable amount of information in just a few slides. The magic is to do this clearly and concisely while providing all the necessary information that the potential investor needs to either ask informed follow-up questions or thoroughly evaluate their fit with the investment opportunity.

Acquis has deep experience in strategic guidance and execution, and our team is comprised of successful founders and seasoned professionals who have managed and led venture growth efforts ranging from early, seed-stage companies to multi-million-dollar clients. Acquis Consulting Group’s white-glove service and fit-for-purpose solutions and strategies deliver meaningful impact for early-stage ventures through industry-leading, multinational organizations. Please reach out to learn more about how Acquis can help your business drive better outcomes.

Disclaimer

This article does not constitute fundraising advice and has been shared for informational purposes only. There are important additional details to consider when strategizing and executing a fundraising approach and/or capital raise for a business. Professionals and subject matter experts should be consulted to help determine what makes the most sense for the specific needs of a business before critical decisions are made and transactions are entered. The information contained herein should not be relied upon to make an investment decision, and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. No representation is being made that any account, product, or strategy will or is likely to achieve profits, losses, or results similar to those discussed, if any.